As the calendar turns, many people quietly reassess their personal lives. January consistently brings a surge in divorce enquiries, yet financial pressure remains one of the biggest reasons people delay taking action.

Earlier research from Legal & General found that around 272,000 people were postponing divorce due to financial concerns, including the cost of living and the perceived expense of the divorce process itself. While delaying can feel like a sensible short-term decision, it often comes at a cost — prolonging emotional strain and making long-term financial planning more difficult.

More recent research now shows that delaying or mishandling financial decisions during divorce doesn’t just pause life — it can permanently reshape it, particularly for those later in life.

The Financial Strain of Divorce: Insights from Legal and General

The financial reality of divorce is often underestimated. Earlier Legal & General findings revealed that one in five divorces were delayed due to economic concerns, and that individuals experienced an average income reduction of £9,700 per year following separation.

Newer data adds an even more sobering dimension.

Legal & General’s latest research shows that later-life divorce now accounts for 17% of all divorces, and that the consequences intensify sharply with age. Among those divorcing after 50:

- One in seven (15%) are forced to delay retirement

- 24% struggle to rebuild savings because they are past peak earning years

- 13% say they will never financially recover

This reframes divorce from a short-term financial challenge into a long-term financial risk, especially where decisions are rushed, avoided, or made without proper protection.

Later-Life Divorce: When Financial Decisions Can’t Be Undone

For those divorcing later in life, there is often less time to recover financially. With fewer working years left and a greater reliance on pensions and long-term assets, mistakes made during divorce can have lifelong consequences.

The knock-on effects identified in the research are significant:

- 23% expect a lower income in retirement

- 32% anticipate downsizing their home

- 20% believe they may no longer be able to leave an inheritance

- 17% feel they may struggle to support adult children financially

These outcomes are not extreme edge cases — they are common consequences where financial matters aren’t dealt with properly at the point of divorce.

Financial Orders Explained: Your Shield Against Future Uncertainty

A crucial — and often misunderstood — part of divorce is the financial consent order.

Contrary to common belief, a divorce alone does not resolve financial matters. Without a legally binding financial consent order, former spouses remain financially linked and exposed to future claims, sometimes decades later.

Earlier Legal & General research found that 69% of divorced people did not have a clean break order, leaving them open to future financial claims from an ex-spouse. The latest findings highlight just how damaging that exposure can become as people approach retirement.

A properly drafted financial consent order:

- legally records what has been agreed

- settles claims over property, savings, pensions, and debts

- brings financial claims to an end where appropriate

- protects both parties from future uncertainty

The Pension Blind Spot: A Costly Oversight

One of the most concerning findings in the latest research is how often pensions are overlooked or misunderstood during divorce.

Despite pensions often being one of the most valuable assets a couple owns:

- Only 25% include pensions in settlement discussions

- 31% give up rights to their partner’s pension entirely

- Just 8% seek financial advice before making these decisions

For many couples, the pension is worth as much — or more — than the family home. Waiving pension rights or failing to address them properly can significantly reduce long-term financial security, particularly later in life when there is little opportunity to recover from poor decisions.

The Easy Online Divorce Advantage: Simplifying the Process

You might reasonably wonder why so many couples leave themselves financially exposed. A common assumption is cost — that protecting your financial future must be expensive.

If you spoke to a traditional high street solicitor, you could easily be quoted £1,000 or more for a basic clean break order.

But protecting your future doesn’t need to cost a fortune.

At Easy Online Divorce, a Clean Break Consent Order starts from £399. We specialise in streamlining the divorce and financial order process, making it accessible, transparent, and cost-effective — without cutting corners.

The real reason many couples divorce without proper financial protection isn’t cost. It’s lack of awareness — both of the risks and of the affordable solutions available.

Protecting Your Future: The Role of Financial Consent Orders

Financial consent orders are essential for all divorcing couples, regardless of whether assets are modest or substantial.

They can cover:

- property and equity

- pensions and future retirement income

- savings and investments

- debts, loans, and credit cards

- ongoing financial claims

They ensure that what you agree today is legally binding tomorrow — and years down the line.

Making Informed Decisions: Why Expert Guidance Matters

Under financial pressure, many people make decisions quickly or without advice — often to keep things amicable or avoid perceived costs.

Legal & General’s research shows that only around 7–8% of divorcing individuals seek financial guidance, increasing the risk of unfair or unbalanced settlements.

At Easy Online Divorce, we prepare consent orders for thousands of separating couples each year. That gives us deep insight into what fair agreements look like — and, crucially, what the court considers fair when approving a consent order.

A Step-by-Step Guide to Obtaining a Financial Consent Order

Our process is clear and guided from start to finish:

- You complete an online questionnaire outlining your financial position

- We draft the consent order and statement of information

- You review and sign digitally

- We submit everything to the court on your behalf

The process typically takes four weeks, or one week using our fast-track service. Once submitted, the court usually takes around four weeks to review and approve the order.

Expanding on Financial Orders: Beyond the Basics

Financial orders can deal with far more than just a clean break. They may include:

- pension sharing arrangements

- spousal maintenance

- deferred property transfers

- responsibility for joint debts

The key is ensuring the agreement is legally enforceable, not just informally agreed.

Case Study: The Real Impact of Financial Orders

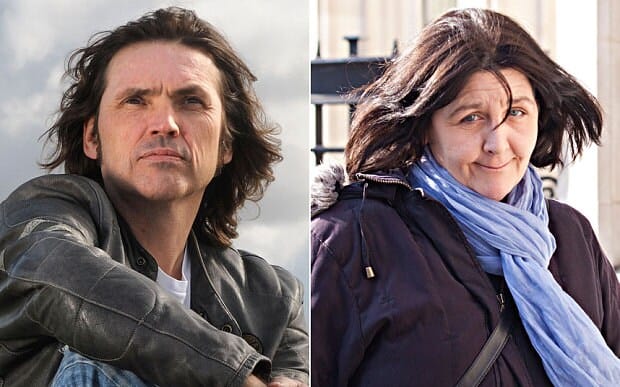

Dale Vince and ex-wife Kathleen Wyatt CREDIT: Photo: (PA/National)

To illustrate the importance of financial orders, let’s consider the case of Wyatt and Vince, who separated in 1984 and divorced in 1992. The couple were penniless at the time of separation, surviving on benefits. They didn’t put a consent order in place – perhaps because they were unaware of it, or maybe they figured they didn’t have anything to protect.

Vince, however, went on to found an eco-energy business and became a multi-millionaire. His ex-wife found out about this and filed a £1.9 million claim against him, despite their short-lived marriage predating the time he became a multi-millionaire from his business.

You can read the full story here, but long story short, in 2015, Vince ended up paying legal fees of more than £500,000 (the law forces costs to be shared amongst the combined wealth of the parties. So since Wyatt was penniless, Vince had to pay Wyatt’s too) and £300,000 to Wyatt as a final settlement.

Testimonials: Hearing from Those Who’ve Benefited

Testimonials from our clients on Trustpilot further underscore the benefits of our services.

Easy Online Divorce – true to their name!

Easy Online Divorce made applying for a consent order a very, very easy process.

They were a joy to work with and provided great support alongside their exemplary service!

If you are looking for support at any point in your divorce, and it’s perhaps all getting a bit overwhelming and too much to manage, or you simply don’t want the admin to deal with, then send Easy Online Divorce an enquiry – I assure you, you won’t look back!

Ryan Payne

101% Service!!!

I can’t thank you and the team enough for a BRILLIANT and EFFICIENT service. So so grateful and your service reduced to a very large extent a lot of anxiety and stress during this divorce process.

I had to leave a review for your company and this is something I hardly do for companies!!

I paid for the fast track (1 week service) and this team were right on time as advertised. The consent order was thoroughly reviewed and more information/clarification was asked where needed. Smooth digital signature feature was incorporated into the application form and off it went. The consent was approved in less than 3 weeks.

This is a one time service for me but will definitely recommend your service to anyone that needs it.

FOM

The Importance of Full Financial Disclosure in Consent Orders

A critical element of any financial consent order is full and honest financial disclosure. This ensures the agreement is fair and reduces the risk of future challenges.

At Easy Online Divorce, we guide clients through this process carefully, ensuring all relevant assets and liabilities are accurately disclosed and properly reflected in the order.

Frequently Asked Questions: Addressing Common Concerns

We have written a detailed article about financial orders that includes an extended FAQ section addressing common queries about financial orders, the divorce process, and how our services can assist. This section provides valuable information to help you decide about your divorce and financial arrangements.

Conclusion: Securing Your Financial Future Post-Divorce

Divorce is challenging, but avoiding or rushing financial decisions often leads to the most damaging outcomes — especially later in life, when there is little opportunity to recover.

A financial consent order is not just a legal formality. It is a vital step in protecting your financial future, your retirement, and your family.

If you’re unsure what you need, take our 50-second test to find out the type of divorce and financial order suitable for your situation.

If you have questions or would like to talk things through, you can email or call us on 0204 586 6112, or book a free consultation with a member of our team.